An accounts payable workflow is the automation of the end-to-end operation of invoice processing. It helps eliminate the manual and repetitive tasks within the process from document collection (paper or digital), to when invoices are paid. Workflows are essential to a consistent, accurate and efficient accounts payable (AP) process. When people refer to “accounts payable workflow” they often mean an implemented software or service that manages that business process.

How does an accounts payable workflow work?

A manual process of one or multiple people receiving invoices in their inbox can result in lost invoices, late fees and even threats of service cancellation. A workflow automates your invoice management. Work triggers automatically send notifications via email or text to let users know of new work assigned to them. Invoices are distributed securely to their proper users and forwarded through successive steps automatically. Invoices can even be prioritized based on specific criteria, and transparency into each task within the process is available. This ensures your deadlines are met and your productivity stays high.

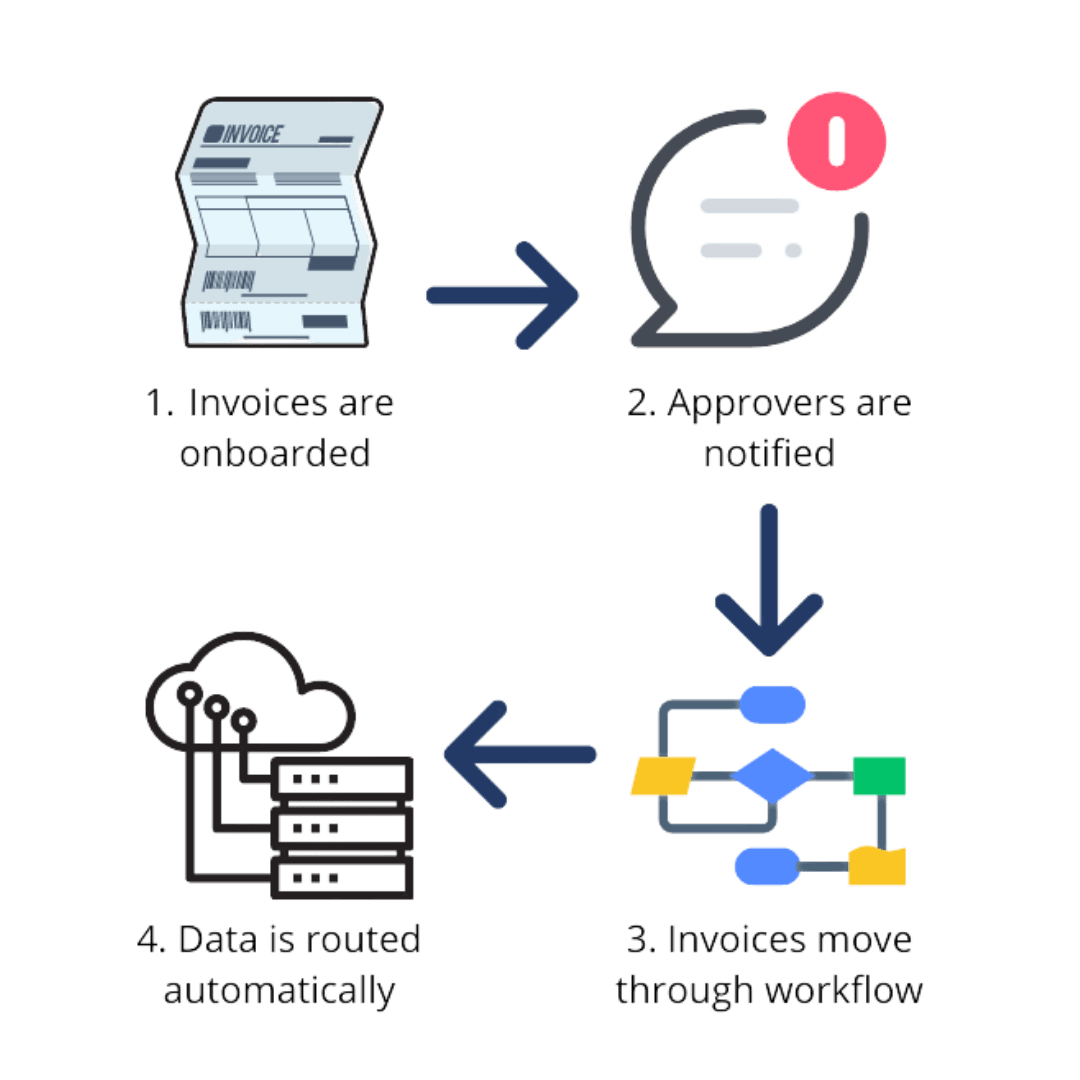

For example, every accounts payable process includes four distinct steps – invoice capture, invoice approval, payment authorization and payment execution. With workflow, an invoice is received and the workflow is started. The invoice is directed to the right person for review and or approval. If it needs to be viewed by another staff member, it can automatically be routed to the next person immediately. The invoice and data can even be routed automatically to a payment processing software for authorization and execution.

What are the benefits of an accounts payable workflow?

There are many benefits to implementing an accounts payable workflow. For starters, it is the best way to streamline your entire AP process. Auto indexing in certain software makes it so your team never has to enter data off an invoice again. You are able to automate the review and approval and accelerate that processing turnaround time to avoid late fees. A proper workflow system even allows you to share revisions to customers easily with publicly facing forms. Another benefit includes the ability to retain invoices properly by setting retention schedules that automatically purge what you don’t need to keep. Overall benefits include a lower cost per invoice, a return on investment in as little as 6 months, faster quarterly and year-end closes, and improved data accuracy and visibility.

Recordsforce’s accounts payable workflow aims to accelerate completion and drive accountability into your organization’s accounts payable process. Learn more about how Recordsforce helped automate a manufacturing company’s accounts payable process with workflow in this case study. Ready to get started?